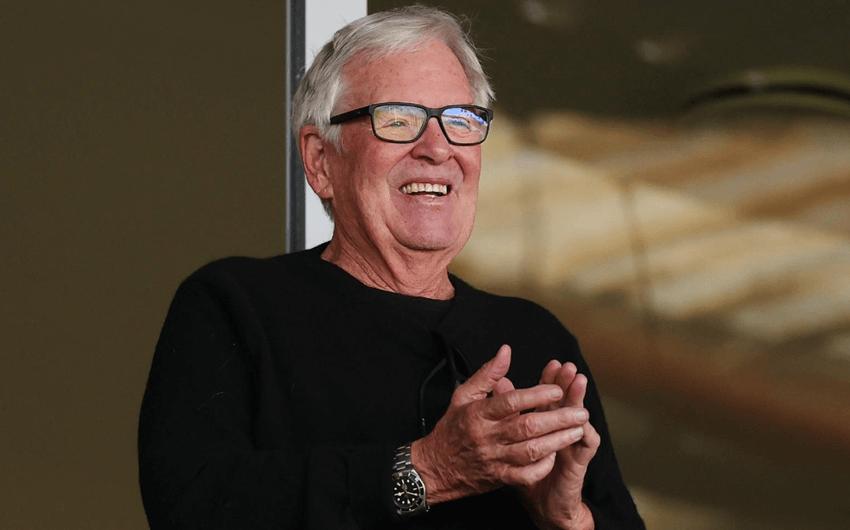

Bill Foley: The Billionaire Builder Behind Insurance Empires and the Vegas Golden Knights

Bill Foley is best known as a self-made billionaire who turned an unglamorous corner of finance—title insurance and real estate services—into a powerhouse business empire, then used that success to reshape the sports world in Las Vegas. He’s the kind of executive whose name rarely trends for flashy reasons, yet his influence shows up in places that matter: the paperwork behind homeownership, the boardrooms where billion-dollar mergers happen, and the arena where an expansion hockey team became a championship contender almost immediately.

For anyone trying to understand who Bill Foley really is, the story isn’t just “rich businessman buys sports team.” It’s a long arc of strategy, scaling, and risk—moving from disciplined corporate leadership into bold, public-facing ownership where the stakes are emotional as well as financial.

Who Bill Foley Is and Why He Matters

Bill Foley, often referenced as William P. Foley II, is an American businessman associated most strongly with the financial services sector. His reputation was built in industries that thrive on trust, regulation, and scale—areas where you don’t win by being loud, but by being precise. He helped build and lead companies that sit at the intersection of real estate and finance, particularly the systems that make property transactions smoother, safer, and more standardized.

That might sound dry until you realize how massive the market is. Real estate changes hands constantly, and every transaction needs infrastructure. The companies that provide that infrastructure—title insurance, escrow, data, and transaction services—can quietly become giants. Foley understood that early, and he operated like someone who wanted not just revenue, but dominance.

Early Career and the Foundation of His Leadership Style

Foley’s background helped shape his reputation as a disciplined operator. He developed a leadership style that leans heavily on process, performance tracking, and long-term planning. People often describe executives like him as “numbers-first,” but that phrase doesn’t fully capture what’s happening. It’s not just numbers—it’s systems. Foley’s career suggests a belief that if you build a system that scales, you can win in industries where individual charisma doesn’t matter much.

That approach becomes especially powerful in financial services, where success is often less about creativity and more about reliability. A title insurer or real estate services company cannot afford chaos. It needs to be boring in the best way: consistent, compliant, and fast. Foley’s operating style fit the sector perfectly.

The Business Empire: Building Power in Title Insurance and Real Estate Services

Foley became widely associated with Fidelity National Financial, a major title insurance and transaction services company. Title insurance isn’t a product most people think about until they buy a home, but it’s essential in the U.S. system. The industry protects buyers and lenders against certain problems tied to property ownership records.

What makes this space a wealth engine is scale. A company that can process transactions efficiently, manage risk well, and maintain strong relationships with lenders and real estate professionals can grow into a dominant force. Foley helped position his business interests to benefit from:

- Volume (more transactions means more revenue opportunities)

- Network effects (relationships and integration with major real estate and lending pipelines)

- Data and technology (tools that reduce friction and speed up closings)

- Acquisitions (buying competitors or complementary businesses to expand reach)

His name also became linked to major moves in property data and mortgage technology through business combinations and corporate spinouts. Even for people who don’t track corporate finance, his influence shows up in the ecosystem that powers buying and selling property at scale.

How Foley Thinks: Consolidation, Efficiency, and “Owning the Rails”

There’s a business philosophy that shows up repeatedly in Foley’s career: control the rails, not just the train. Instead of chasing consumer-facing fame, he focused on the infrastructure behind large financial flows. That means owning services that are always needed—regardless of which brand is currently trendy or which housing market is hottest.

This approach often includes consolidation. In industries with many fragmented players, consolidation can create major advantages:

- lower per-transaction costs through scale

- stronger bargaining power with partners and vendors

- more standardized operations and compliance structures

- broader geographic reach and market coverage

Foley’s success suggests he has been comfortable playing the long game: building businesses that may not be glamorous, but are extremely profitable when executed well.

The Big Pivot: Bringing the NHL to Las Vegas

For many people, Bill Foley became truly recognizable when he led the push to bring an NHL team to Las Vegas. At the time, it was still unusual to see Las Vegas treated as a “serious” major-league sports city. There was skepticism about whether hockey could thrive in the desert, whether fans would show up long-term, and whether an expansion team could build a real identity.

Foley didn’t treat the franchise like a vanity purchase. He treated it like a business and a civic project. That meant:

- building a brand that felt native to Vegas, not imported

- creating a game-night experience that matched the city’s entertainment DNA

- investing in talent and management rather than accepting “expansion team mediocrity”

- making the team a community symbol, not just a tourist attraction

The result was the Vegas Golden Knights becoming one of the most successful expansion stories in modern sports. The team quickly developed a passionate fanbase and became a central part of Las Vegas identity.

Why the Golden Knights Model Worked

The early success of the Golden Knights wasn’t accidental. It reflected a deliberate ownership strategy. A lot of sports teams are run like legacy institutions where tradition matters more than optimization. Foley’s approach looked more like modern business: build the organization like a high-performing company.

Key elements that helped:

- Clear identity: The team’s branding and presentation were bold and consistent.

- Entertainment-first execution: Vegas fans were offered a full spectacle, not just a game.

- Strong organizational ambition: The franchise acted like it wanted to win early, not “eventually.”

- Community integration: The team became emotionally meaningful to locals, not just a product.

Sports ownership is often judged by championships, but it’s also about institutional trust. Fans want to feel their team is trying. Under Foley, the Golden Knights were rarely accused of complacency. The message was clear: the organization expected excellence.

Leadership Reputation: Admired, Tough, and Sometimes Polarizing

Executives who build large empires tend to be admired and criticized at the same time. Foley’s reputation fits that pattern. Supporters see a disciplined builder—someone who scaled companies, created jobs, and took big risks that paid off. Critics sometimes focus on the harder edges of corporate leadership: aggressive dealmaking, relentless cost control, and the reality that consolidation can reshape industries in ways not everyone loves.

In sports, that same intensity can feel polarizing. Fans often love owners who spend money and pursue wins, but they also dislike moves that feel cold—like quick roster decisions or a “business-first” tone when emotions run high. A high-performance culture can be thrilling, but it can also feel ruthless.

Still, Foley’s public track record suggests consistency in values: he wants results, he invests to get them, and he expects organizations to perform at a high level.

Wealth and Influence: What His Net Worth Represents

Bill Foley is commonly described as a billionaire, but the more interesting detail is what that wealth represents. It’s not built from a single viral product or one lucky tech bet. It’s built from:

- years of leadership in financial infrastructure

- ownership stakes in large, transaction-driven businesses

- the ability to execute major mergers and long-term growth strategies

- diversification into sports and entertainment assets

That kind of wealth tends to be durable because it’s tied to systems people rely on—real estate transactions, financial services, and large-scale operations—rather than one entertainment trend.

Philanthropy and Civic Presence

High-profile owners in a city like Las Vegas inevitably become civic figures. Owning a major sports franchise doesn’t just create financial influence; it creates cultural influence. While philanthropy details can vary year to year, sports ownership typically pushes owners into community roles through local partnerships, charitable activities, and public-facing initiatives tied to the team’s identity.

In many cases, the strongest legacy of a sports owner isn’t the profit. It’s the sense that they helped build part of the city’s identity—something fans can pass down to their kids as tradition.

The Bottom Line

Bill Foley is a rare blend of behind-the-scenes empire builder and high-visibility sports owner. He made his fortune in the infrastructure of real estate and finance—fields that reward scale, systems, and precision—then used that power to create a major-league sports identity for Las Vegas through the Vegas Golden Knights. His reputation is rooted in ambition and execution: he builds aggressively, expects performance, and plays for long-term impact rather than short-term applause.

Whether someone knows him from boardrooms or from the roar of an NHL arena, Foley’s story is ultimately about the same thing: building systems that win—then proving they can win under the bright lights, too.

image source: https://www.sportingnews.com/us/nhl/news/golden-knights-owner-bill-foley-net-worth-earnings/roam37qabv9vge6vjbpwsrdp